In the world of finance, few economic indicators hold as much weight as the Non-Farm Payrolls (NFP). Released on the first Friday of every month, the NFP report can send ripples throughout the financial markets, influencing everything from currency values to stock prices. But what exactly is the NFP, and why does it matter so much? Let’s dive in.

What exactly is Non-Farm Payrolls (NFP)?

The Non-Farm Payrolls report represents the number of jobs added or lost in the U.S. economy over the last month, excluding jobs in the farming industry. The farming industry is excluded due to its seasonal hiring, which could potentially skew the data. The NFP is a critical economic indicator because employment is a significant factor in determining the health of an economy.

How does NFP data affect Economics as whole?

- Consumer Spending: Employment levels directly influence consumer spending. When employment is high, consumers have more disposable income, leading to increased spending and, consequently, economic growth.

- Central Bank Policies: Central banks, like the Federal Reserve, closely monitor the NFP. Strong employment numbers might lead to interest rate hikes to curb inflation, while weak numbers could lead to rate cuts to stimulate borrowing and investment.

- Investor Sentiment: The NFP can influence investor sentiment. Positive numbers can boost confidence, leading to increased investment in stocks, while negative numbers can have the opposite effect.

You can check public sentiment data in myfxbook:

https://www.myfxbook.com/community/outlook

NFP and the Dollar Index

The Dollar Index measures the value of the U.S. dollar relative to a basket of foreign currencies. Since the U.S. economy plays a pivotal role in the global economy, any significant news, like the NFP, can influence the Dollar Index.

- Positive NFP Readings: A higher-than-expected NFP reading can strengthen the U.S. dollar as it indicates a robust U.S. economy. A strong economy can attract foreign investment, increasing demand for the U.S. dollar.

- Negative NFP Readings: A lower-than-expected NFP reading can weaken the U.S. dollar. A weak employment number can signal economic slowdown, making U.S. assets less attractive to foreign investors.

NFP’s influence on Technical Analysis

While this blog post won’t delve deep into technical analysis, it’s essential to understand that fundamental data like the NFP can influence technical patterns. For instance:

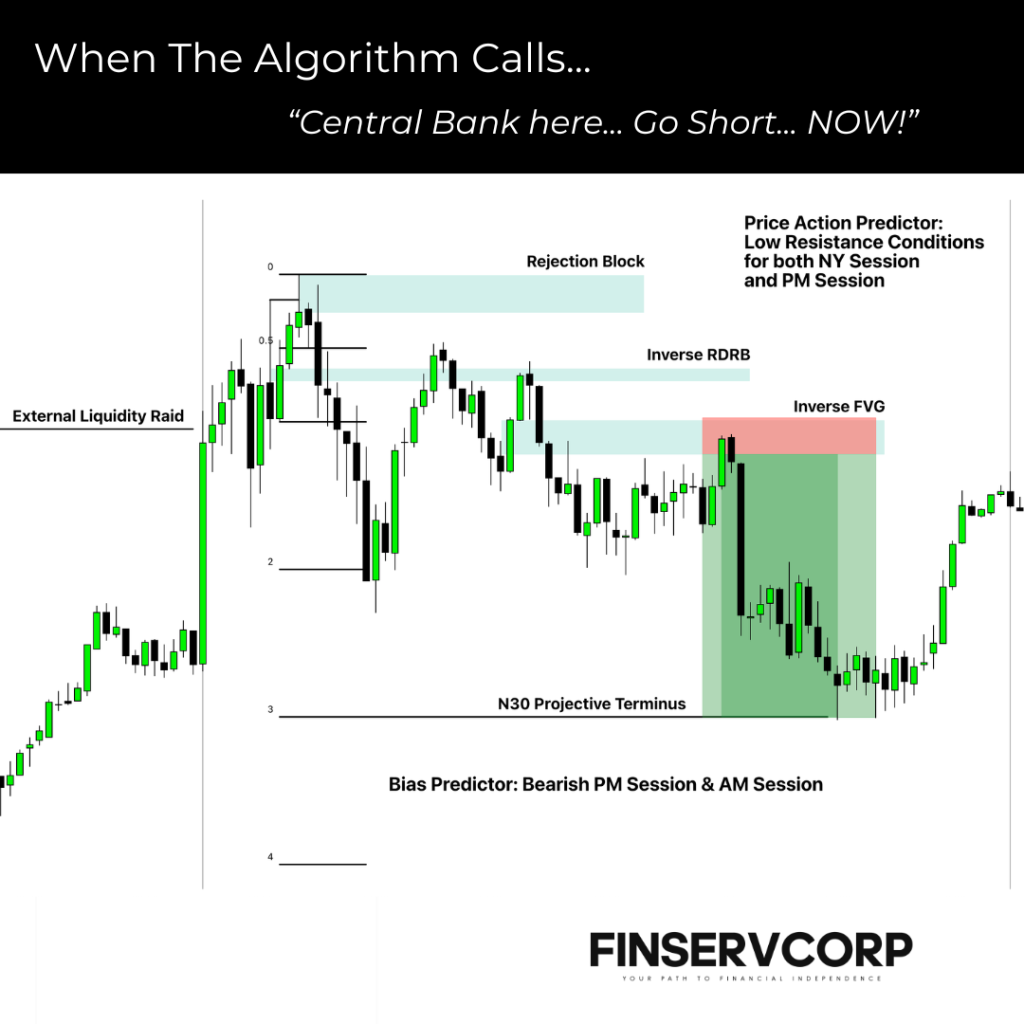

- Price Volatility: On NFP release days, traders can expect increased price volatility, leading to potential breakouts or reversals in existing trends through filling inefficiencies and raiding external liquidity pools

- Support and Resistance Levels: Strong NFP numbers can push prices to test Premium levels, while weak numbers can lead to tests of Discount levels.

Concluding Note

The Non-Farm Payrolls report is more than just a number. It’s a reflection of the U.S. economy’s health and a significant driver of financial market movements. Whether you’re a trader, investor, or just someone keen on understanding the economy, keeping an eye on the NFP can offer valuable insights into the broader economic landscape.

Stay tuned for more insights and deep dives into the world of finance and trading with The Trading Academy!