Gold is an asset that gains traction during periods of low interest and / or high inflation. Therefore, it is an alternative asset class most of the time for investors to pour their money into.

High Interest Rate Environments

Higher interest rates attract investment flows into interest bearing securities. As such, money circulation goes out of Gold, thereby causing a Gold market crash. The opposite is true for a Low Interest Rate Environment

High Inflation Environments

When facing periods of high inflation, Gold is seen by investors as an inflation-hedge. Therefore, the money flowing into Gold is seen to increase. Thereby causing a Gold market rally. The opposite is true for a High Interest Rate Environment

Deriving a Bias using Interest Rates and Inflation Numbers

Interest Rates are the key economic and financial indicators that control all markets. Bonds and their rates set by the Fed rule all asset classes. Whereas, inflation is only a ‘pseudo-state’ of an economy.

If interest rates are seen to rise while inflation is low, Gold is definitely bearish as money will flow into interest bearing securities

If interest rates are seen to rise while inflation is high, Gold is still bearish as interest bearing securities would offer more in terms of higher interest that will counter the inflation as per inflation adjusted returns

If interest rates are seen to not change while inflation is high, Gold will spark a bull run as there is no particular interest in the interest bearing securities if there is no rise in the interest rates

If interest rates are seen to not change while inflation is low, Gold will face a sideways market or a crash as there will be no particular interest in the interest bearing securities or Gold themselves. Money will flow into the stock market

If interest rates are seen to be low while inflation is either high or low, money will still flow into Gold as that is the only attractive asset for this economic condition

To Conclude

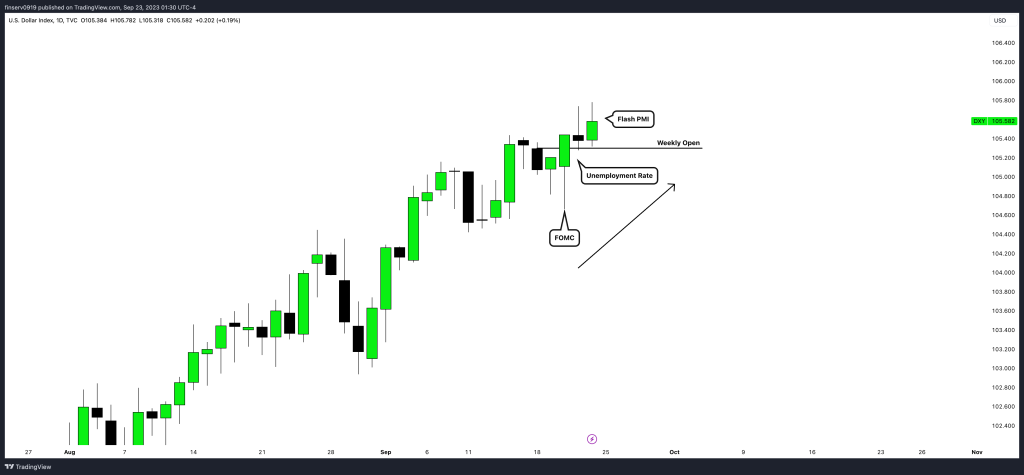

When looking at the weekly expansion of Gold or any asset class for that matter, it is important to note that the expansion itself is a consequence of the prevailing economic condition at hand. These things are set the previous week or during the current week after a High Impact News Driver has occurred.

Be sure to follow us on instagram at @finservcorp and subscribe to our YouTube at @shaundytradesfx to keep up with our time-based trading content and updates to Mentorship Enrolments!