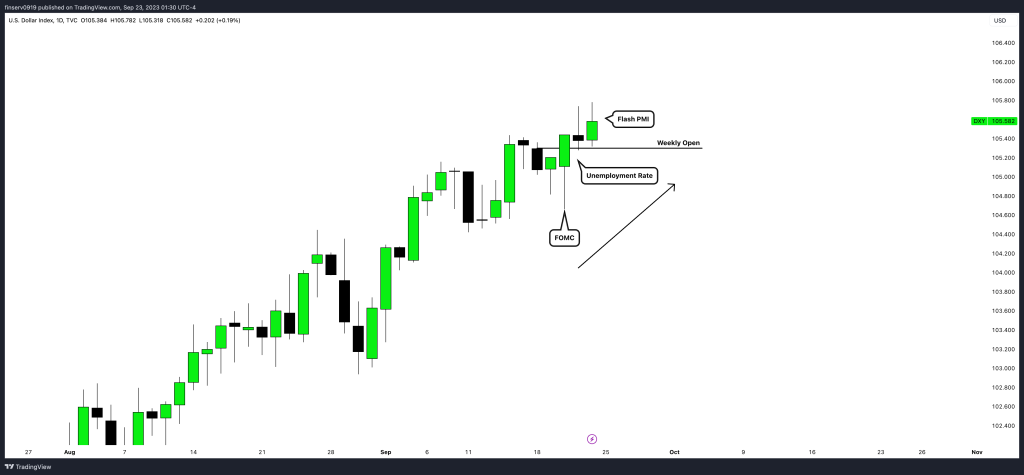

The financial markets have been buzzing with activity this week, and the Dollar Index (DXY) has been at the forefront of many discussions. Here’s a breakdown of the key events and their implications:

1. DXY (Dollar Index) Rises Amidst Positive Fundamental Outputs

The Dollar Index, which measures the value of the US dollar against a basket of six major world currencies, has seen a significant uptick. This rise can be attributed to positive outputs from high-impact news drivers. While specific data points from this week’s USD fundamental data were not immediately available, it’s evident that the US economy has been posting encouraging numbers. Investors and traders should keep an eye on sources like Dukascopy Bank and DailyFX for detailed fundamental analyses and updates.

2. Index Futures Crash

In a surprising turn of events, index futures took a nosedive. While the exact reasons for this sharp decline are still being analyzed, it’s crucial for traders and investors to remain vigilant and monitor global economic indicators and geopolitical events that could influence market sentiment.

The relationship between the DXY and NASDAQ in this case is negative. When DXY rises, NASDAQ should fall.

3. Gold Rallies but Retreats Post-FOMC

Gold, often considered a safe-haven asset, witnessed a rally earlier this week. However, post the Federal Open Market Committee (FOMC) meeting, it gave back half of its gains. The FOMC’s decisions and statements play a pivotal role in influencing the price of gold, as it often moves inversely to the US dollar.

Conclusion:

The financial markets are in a state of flux, with the DXY showing strength, index futures facing headwinds, and gold exhibiting volatility. As always, traders and investors are advised to stay informed, keep an eye on global economic indicators, and make decisions based on thorough research and analysis.

For those interested in diving deeper into the intricacies of the financial markets and the factors influencing them, stay tuned to our blog for regular updates and in-depth analyses.