The ‘Hindsight’ Image

The Analysis

This trade was called out in the following YouTube video:

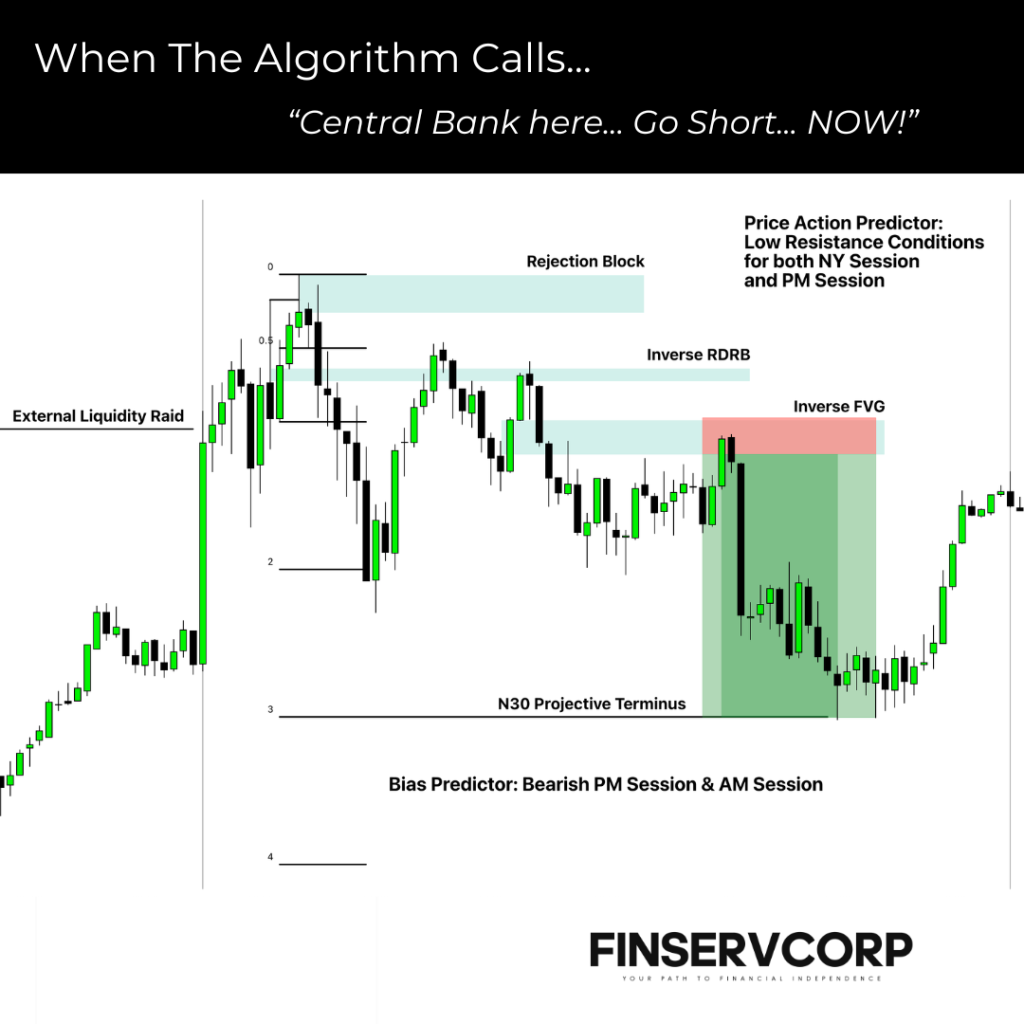

Now, over here based on the analysis is that price took out External Liquidity As we know, based on the function of price in terms of its sequence of movement, a reversal will always form around an External Liquidity Pool. To further add to that point, an expansion in the direction of actual order flow will then be facilitated through the usage of Fair Value points of interests.

Now, these Fair Value points of interests come in many forms:

- Your True Fair Value Gap

- Balanced Price Range (BPR)

- Inverse Fair Value Gap

- Inverse Redelivered Rebalance

I know what you are thinking:

‘BPR and Inverse Fair Value Gaps are the same !’

I hate to break it to you… They are not the same

In selecting the area in which you are going to sell from in this example, it will of course be inside of premium. The upper half of the dealing range that you are presented with. As explained in the YouTube video linked above on how to use accumulation fractals in your trading, I elected to use the Inverse Fair Value Gap.

As for the targeting system used for this trade, I used my target selection tool which I call my N30 Projections. This is a method whereby I use the Manipulated Range in order to keep my take profit 2 Standard Deviations away. However, in reality I just kept my profit target at the immediate range low just to call it a day.

The Role played by our Bias Predictor

As you, the audience know by now from our social media, we have a bias predictor that accurately predicts the bias for any asset under the US Regulatory Framework. It works 75%+ of the time and when there’s no extreme manipulation and there are obvious points of interests nearby, it has a successful prediction rate of 100%. While the indicator that is out (which is a paid by the way!) predicts the daily bias, we have techniques using nodes of time and price that predicts the bias for individual session and custom segments of time.

We used a mixture of both to solidify our reasoning for this sell on NASDAQ that spanned both the AM Session and the PM Session.

Concluding Note

I hope you found this insightful and be sure to leave a like and share this blog around if you found this content interesting.

Now, if it opened up rabbit holes for you, all you have to do is join us in our private mentorship. I’ll even throw in a lifetime discount of 20% (Code: tta20)