The foreign exchange (forex) market is the largest and most liquid financial market in the world, with daily trading volumes exceeding $6 trillion. Given its global nature, the forex market is influenced by a myriad of factors, with global news being one of the most significant drivers. In this article, we’ll delve deep into understanding how global news events impact currency valuations and forex trading.

1. Understanding the Basics

Before diving into specifics, it’s essential to understand that the forex market operates 24 hours a day, five days a week, spanning across major financial centers like London, New York, Tokyo, and Sydney. This continuous operation means that forex traders need to be on their toes, monitoring global news around the clock.

2. High Impact News Drivers

Several news events have a profound impact on currency valuations. Some of the most influential include:

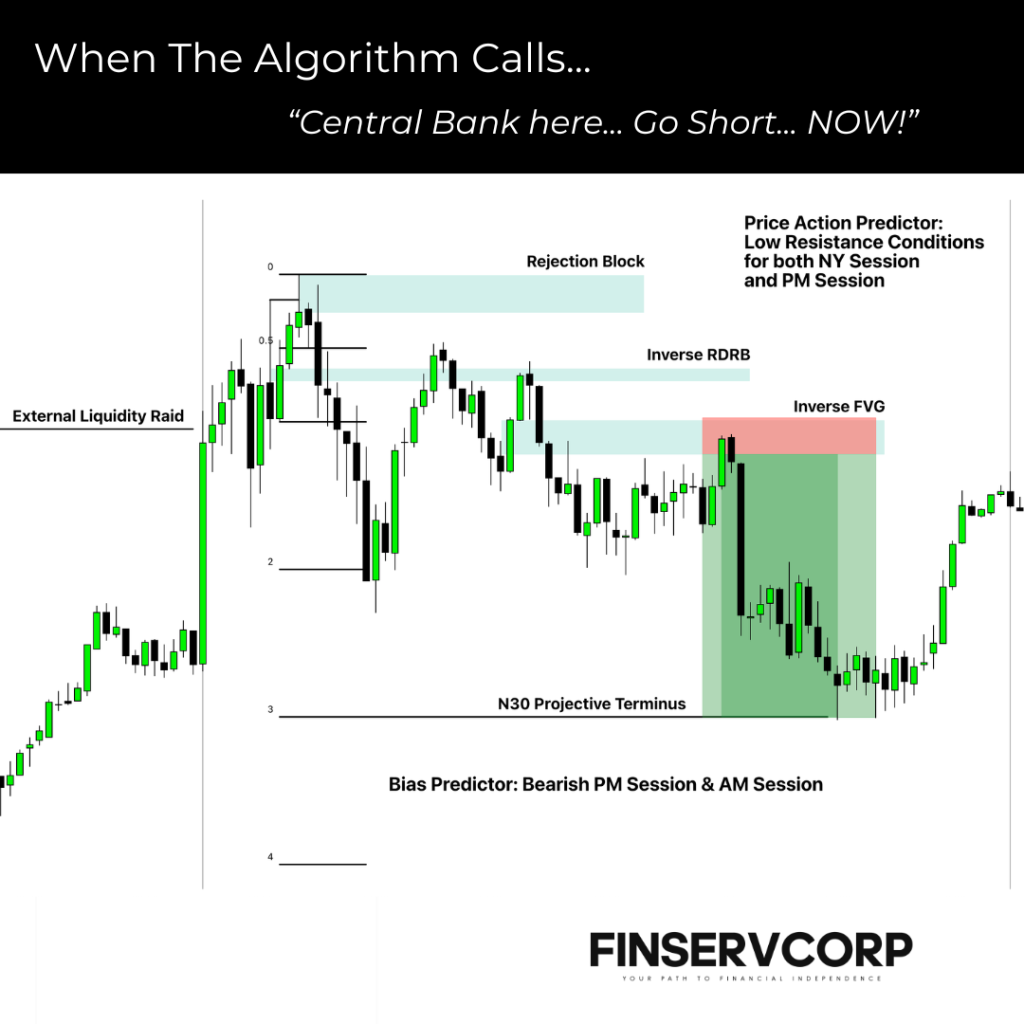

- Central Bank Decisions: Announcements related to interest rates, monetary policy, and quantitative easing can lead to significant forex market movements. For instance, a rate hike by the Federal Reserve can boost the US dollar as higher interest rates offer lenders better returns relative to other currencies.

- Economic Indicators: Data releases such as GDP growth, unemployment rates, inflation rates (CPI), and trade balances provide insights into a country’s economic health, influencing its currency’s value.

- Political Events: Elections, referendums, and geopolitical tensions can introduce uncertainty, leading to currency volatility. For example, Brexit led to significant fluctuations in the British Pound.

- Natural Disasters and Pandemics: Unexpected events like earthquakes, hurricanes, or global health crises (e.g., COVID-19) can have short-term impacts on a country’s currency.

3. The Role of Forex Calendars

Platforms like MyFXBook and ForexFactory offer forex calendars that list upcoming news events, their expected impact, and the actual vs. forecasted data. These calendars are invaluable tools for traders, helping them anticipate market movements and strategize accordingly.

4. The Immediate Reaction

Upon the release of significant news, the forex market can react almost instantaneously. Automated trading systems, also known as algorithmic trading, can execute trades within milliseconds, leading to rapid price movements. It’s not uncommon to see major currency pairs move by 50-100 pips or more within minutes of a high-impact news release.

5. The Importance of Sentiment Analysis

Beyond the actual news data, traders also gauge market sentiment. For instance, even if an economic indicator is positive, if it doesn’t meet market expectations, the currency might still decline. Sentiment analysis tools can help traders understand the market’s mood and make informed decisions.

6. Strategies for Trading News Events

Forex traders often employ specific strategies for trading news events. Some might take positions before the news release, anticipating the market’s move, while others might wait for the news and then trade based on the market’s reaction. It’s crucial to have a risk management strategy in place, given the increased volatility during these times.

7. Conclusion

Global news plays a pivotal role in shaping the forex market’s dynamics. Whether you’re a seasoned trader or just starting, understanding the impact of news events and how to navigate them is crucial for success. By staying informed, using tools like forex calendars, and employing sound strategies, traders can capitalize on the opportunities presented by global news events.

If you are one of the inconsistent and strategy-hopping few in the trading community looking to better yourself and your trading, make sure to send us an email or a message on telegram to get you started on our exclusive One on One mentorship strictly designed for your success

Telegram:

Disclaimer: Forex trading involves significant risk of loss and is not suitable for all investors. Always conduct thorough research and consult with a financial advisor before making trading decisions.